The Draft Welsh Budget published yesterday represented an important milestone in the development of Welsh fiscal policy, taking advantage of Wales’ new tax powers and the freedoms and flexibilities on capital and the use of reserves enabled by the new Fiscal Framework Agreement. But the straightjacket of austerity still means that the total resource allocation to departments for day-to-day services is forecast to continue to fall in real terms by 2019-20.

The figures published yesterday are high level, in accordance with an agreed new procedure within the Assembly, with more detail to come later in October. Analysis at this stage can only be limited.

The Draft Budget makes use of Wales’ new tax powers over the Land Transactions Tax and Landfill Disposals Tax. The new tax proposals are accompanied by a Welsh Tax policy report that highlights the links between tax decisions and the resources to fund public services. Changes to Land Transaction Tax increase the starting threshold for homebuyers with the aim of benefitting first time buyers. The changes to the Landfill Disposals Tax increase the deterrent to illegal waste disposal. The revenues from these taxes are forecast to increase by around £35 million by 2019-20[1] – their importance is probably more as policy levers than big revenue-earners. The Draft Budget reaffirms the commitment not to change the Welsh Rate of Income Tax when devolved. So the interest in tax announcements in future budgets may be in other tax innovations.

The Draft Budget also announces the use of new borrowing powers to boost the 3-year £4.8 billion plans for devolved capital spending and also the use of ‘innovative finance’, the mutual investment model. The new higher capital borrowing powers set as part of the fiscal framework will add £375 million and the innovative finance and other arrangements up to a further £1.7 billion. These additions take on a particular significance because the traditionally sourced capital spending (conventional capital grant and financial transactions capital funding provided through the block grant) looks set to fall slightly in real terms over the three years. The big headline is the commitment to 20,000 affordable homes.[2]

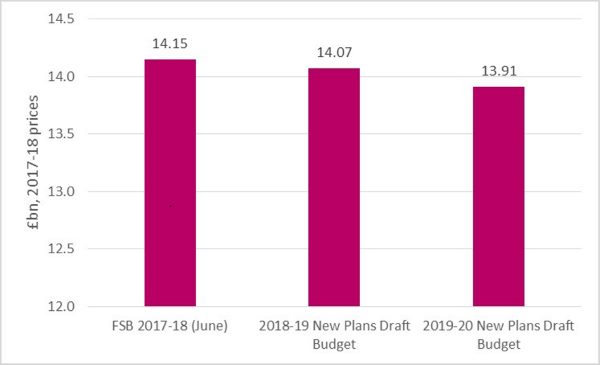

Much attention will inevitably be on the plans for resource spending which include figures for 2 years, 2018-19 and (indicatively) 2019-20. In broad terms, the total resource allocations to departments (MEGs) look set to fall in real terms by 0.4% in 2018-19 compared with the current 2017-18 June supplementary budget, and by nearly 2% in 2019-20. Previous figures based on current UK spending plans have suggested that 2019-20 could be a challenging year for the Welsh Budget.

The Chancellor is under pressure to ease austerity and his Autumn Budget in November will provide greater clarity about his future strategy on tax and spending. The decision to delay the target date for eradicating the deficit will give him some room to manoeuvre. The Welsh Government is calling on the Chancellor to cancel his, so far unallocated, plans for £3.5 billion efficiency savings and to fund public sector pay increases.

Total Allocation to Welsh Government MEGs including NDR, 2017-18 prices, £bn.

Source: Draft Budget 2018-19 Outline proposals, Table 5.3, and First Supplementary Budget 2017-18, Table 2.2, September 2017 GDP deflator.

The high-level tables for allocations to departments allow for only limited analysis. Two MEGs, Health, Wellbeing and Sport and Communities and Children, both show real-terms increases with reductions for all the other MEGs. The Communities & Children allocation includes new funding for childcare and maintaining the Supporting People programme.

Within the Health MEG, the Budget includes an extra £450 million for the NHS over 2 years: the balance between resource spending and capital will become clearer when the detailed figures are published. Insofar as it is possible to tell, it looks as though the headline NHS increases are probably in line with previous increases.

The local government settlement will be announced next week. The figures are complicated by the transfer of specific grants into the revenue support grant, including a transfer from the Environment and Rural Affairs MEG. It looks as though the underlying finances for local government will continue to be under pressure, hence the warnings about possible council tax increases. The Welsh Government is still emphasising the protection of funding for schools and social services.

The Draft Budget includes the 2-year deal with Plaid Cymru. The deal was announced as amounting to £210 million – of which the detail available so far specifies £84 million in 2018-19 and £108 million in 2019-20, split between resource and capital. There have been several such deals over the years and they often have a mix of very specific and more strategic commitments.

Attention rightly focusses on the detail but the overall shape of resource spending looks consistent with the pattern of recent years. Downward pressure on the Welsh Block grant continues to restrict the scope for change and local government anticipates further cuts to some services.

Further detail will become available over the next few weeks. The Final Budget in December will have the opportunity to take advantage of any changes announced in the UK Autumn Budget, at which point it should be possible to get a clearer picture of how Welsh public services will fare financially over the next two to three years.

[1] This is calculated by looking at the difference between tax revenue forecast in the Draft Budget for 2019-20 (in 2017-18 prices) and the OBR devolved tax forecast for 2017-18 for LDT and LTT.

[2] This commitment is ongoing as part of the Welsh Government’s commitment to invest £1.4bn over the Assembly term to deliver 20,000 affordable homes by 2021.

Author: Dr Daria Luchinskaya